Oil and gas companies had a record year in 2022 and continued to improve their positions in the eyes of investors.

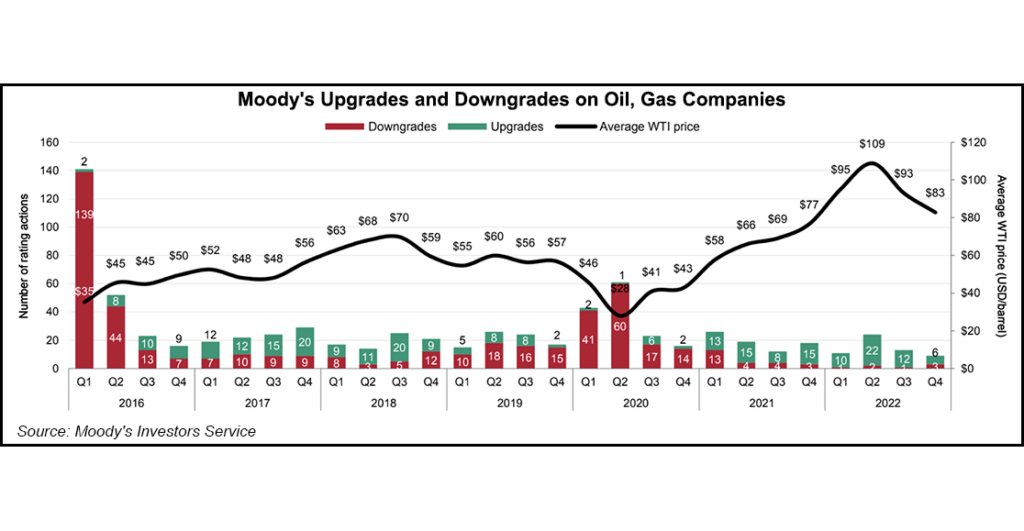

In a new report, credit ratings analysts at Moody’s Investors Services said upgrades in the oil and gas industry far outpaced downgrades in 2022, mainly because of considerable debt reduction policies at companies across the hydrocarbons value chain. Moody’s noted a similar trend in 2021.

The analysts, however, said they saw the pace of upgrades slowing in 2023, with oil and gas companies still remaining focused on maximizing shareholder distributions. Going forward, initiatives to reduce emissions would also impact cash flow at oil and gas companies, the analysts said.

“Industry cycles will continue to influence oil and gas companies’ financial performance, but we expect less robust profitability and cash flow at future cyclical peaks once these initiatives begin to change the trajectory of future oil and gas demand, and we expect cyclical troughs to be lower,” said Alam Sajjad, senior credit officer.

Robust industry conditions were particularly evident in the Americas in 2022, the analysts said. Two-thirds of the total 21 global downgrades in 2022 involved companies outside of the Americas, including 10 that resulted from the downgrade of the government of Russia.

Globally, Moody’s upgraded 31 exploration and production (E&P) companies in 2022, and downgraded only four companies. Two of the E&P downgrades, Kosmos Energy Ltd. and Tullow Oil plc, stemmed from a downgrade of the government of Ghana.

Petróleos Mexicanos, or Pemex, also received a downgrade based on a sovereign downgrade on the government of Mexico.

“The midstream sector also strengthened with the improving health of their E&P customers, with higher production volumes and reduced growth capital spending freeing up cash flow for midstream companies to reduce debt,” the analysts said.

Targa Resources Corp. and Hess Corp. became investment-grade and were deemed “rising stars” in 2022. Targa’s upgrade followed “substantial deleveraging coupled with a strengthening of its business and simplification of its capital structure,” while Hess saw “the rising maturity of its Guyana development and the visible transformation of the company’s scale and cash flow generation capacity.”

Moody’s downgraded seven investment-grade companies to speculative-grade in 2022. All of these “fallen angels” were Russian companies.

Companies that have negative outlooks entering 2023 include Colombia’s state oil and gas firm Ecopetrol SA, where there are concerns over “elevated refinancing risk and financial policies,” according to Moody’s. Colombian oil pipeline firm Oleoducto Central SA is another, a reflection of Ecopetrol’s indirect ownership of 70% of Ocensa. Ecopetrol is also Ocensa’s primary customer.

Source: https://www.naturalgasintel.com/