Defunding hydrocarbon is a costly mistake

The International Energy Forum has called on companies to raise investment in oil (USO) and natural gas (UNG) production to $523 billion a year by the end of this decade to prevent a surge in energy prices and economic unrest. They pointed out how spending on oil and gas projects slumped 30% to $309 billion in 2020 and had only recovered slightly in 2021. Now, you may dismiss these by saying that IEF is close to oil giant Saudi Aramco, and that their business interests are aligned in this matter.

There could be “chaos” unless governments stopped discouraging investment in fossil fuels. – Saudi Aramco CEO

However, even the Technoking of Tesla (TSLA) echoes this sentiment in very similar words.

Realistically I think we need to use oil and gas in the short term, because otherwise civilization will crumble – Elon Musk

And JP Morgan Chase (JPM) CEO Jamie Dimon used similar words in an Oversight Committee hearing, when Rep. Rashida Tlaib pressed a cadre of banking executives sitting before the investigatory panel on whether they would commit to stop funding new fossil fuel projects.

Absolutely not, and that would be the road to hell for America – Jamie Dimon

Even before the Russo-Ukraine war (Feb 2022), natural gas shortages and weak winds led to high energy prices in Europe last year (Dec 2021). The war and associated sanctions on Russia exacerbated the situation causing widespread shortages in Europe and governments around the world are grappling for energy independence.

Private Equity Is Pouring Money into Oil & Gas

In 2019, Goldman Sachs (GS) became the first big U.S. bank to rule out financing new oil exploration, drilling in the Arctic, and new thermal coal mines globally. In addition, dozens of large European banks have also cut financing for hydrocarbon projects. Additionally, pension funds, endowments, and other institutional investors are increasingly moving away from fossil fuel-related assets due to pressure from environmental activists and political leaders in their constituencies.

There is a void created by big banks, and big private equity (“PE”) is happily taking their place. Some of the biggest PE firms – Apollo Global Management, Blackstone Group, Brookfield Asset Management, Carlyle Group, KKR, and Warburg Pincus are collectively overseeing $216 billion worth of hydrocarbon assets. It is noteworthy that the 10 largest private equity funds have 80% of their energy investments in hydrocarbons to support drilling, fracking, transportation, storage, processing, and refinement of hydrocarbons to generate energy.

According to the Energy Information Administration, in 2021, 61% of U.S. utility-scale electricity generation was derived from hydrocarbons — coal, natural gas, petroleum, and other gasses; 19% was from nuclear energy, and 20% was from renewables. The agency’s forecasts show that oil and gas will remain dominant sources of energy past 2050.

It’s kind of make-believe to think that we can actually replace three (leading) forms of energy this time – Wil VanLoh, CEO, Quantum

There is almost nothing I can do to prevent our elected representatives from making a massive mistake that is already proving to be very costly to our wallets. But I am ready to position my portfolio to secure the tailwinds from the long-term stickiness of hydrocarbon demand. I am following suit with private equity in loading up on energy names because the current policy landscape indicates above-average prices in the long term. My objective is income, so I am collecting strong dividends from these quality energy picks.

Pick #1: OKE – Yield 5.7%

It is no secret that energy commodity prices are volatile. There are too many factors that impact supply and demand, including but not limited to political decisions, geopolitical tensions, China’s Zero COVID policy, and fears of a global economic recession.

If you are an income investor, midstream is a must-have in your portfolio. This is because midstream companies largely have fixed-fee operating models where their earnings are not correlated with the prices of hydrocarbon commodities.

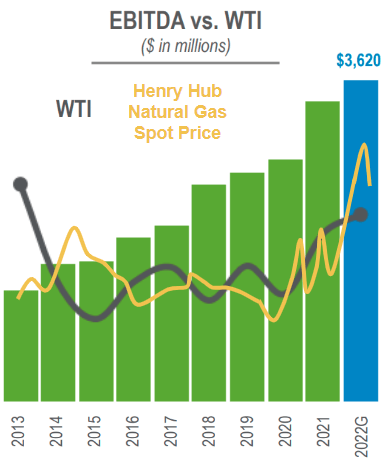

Look at ONEOK, Inc. (OKE), for instance, the 8th largest North American midstream company by market cap. Over the past decade, the company has reported gradually growing EBITDA despite fluctuating energy prices. This period is appropriate since we have seen the volatile WTI surge to $150 and briefly collapse below $0.

OneOK Investor Presentation (November 2022)

OKE effectively shields investors from commodity price swings through long-term fee-based contracts. Let me describe what long-term means.

OKE’s Natural Gas Pipeline segment benefits from the growing demand for natural gas storage and transportation services. The company recently expanded its Texas storage facilities, fully subscribed through 2032. Additionally, during the conference call, the company announced the ongoing expansion of its storage facilities in Oklahoma to enable an additional 4 billion cubic feet of storage capacity to be contracted. Interestingly, this project will only be completed in April but is already 90% subscribed through 2029. This is the competitive advantage of asset-rich midstream companies. Their infrastructure gets booked for many years even before it is ready.

During Q3, OKE reported an impressive 13% YoY EPS growth, a 10% increase in net income to $431.8 million, and a 4% YoY increase in EBITDA. The company reported a YoY 10% reduction in interest expenses, and at the end of the quarter, OKE’s net debt-to-EBITDA stood at a respectable 3.8x. While the company has been covering its quarterly dividend payments with its cash from opening activities, it is noteworthy that in Q3, the quarterly dividend was covered by the EPS. This is a healthy sign that operating fundamentals and profitability continue to improve, and investors can expect improving capital returns from the company. Here is what the CEO had to say:

With our positive earnings growth indications for 2023, our payout ratio and our debt-to-EBITDA metrics are indicating that we are going to have more flexibility to execute on one or more of the capital allocation levers that are going to be available to us to create that value for our shareholders as we progress through 2023.” – Pierce Norton, CEO

OKE is a respectable dividend steward with over 25 years of steadily growing payments. While the payment has remained steady since 2019, its $0.935/share quarterly dividend calculates to a healthy 5.7% yield.

To all the ESG-focused investors who believe that the hydrocarbon industry is evil, I want to point out that OKE’s ESG rating was recently reviewed and updated by MSCI to AAA. This is the highest rating available, denoting industry leadership status, and is granted to less than 5% of reviewed companies.

This year, the U.S. became the world’s largest liquefied natural gas (“LNG”) exporter due to soaring demand from Asia and Europe. Analysts at East Daley Capital Inc. have projected that U.S. LNG exports will grow to 26.3 Bcf/d by 2030, double the current export levels. Companies like OKE, whose assets form the backbone for the storage, transportation, and processing of natural gas and its derivatives, are well-positioned to see demand consistency, earnings growth, and asset-based enrichment. In the meantime, investors can collect growing dividends without the stress of commodity price volatility.

Pick #2: VNOM – Yield 7.4%*

Usually, when hydrocarbon energy companies are discussed, the following comes to mind immediately

Significant capital expenses to set up

Above-average debt levels

Continuous maintenance and upgrades

Intense regulatory oversight.

Despite all this, the well-managed companies in this industry are reliable dividend payers, and I hold them in my portfolio for income. However, can I obtain exposure to hydrocarbons without the bulk of the hassles mentioned above? (I have been taught that I can’t have my cake and eat it).

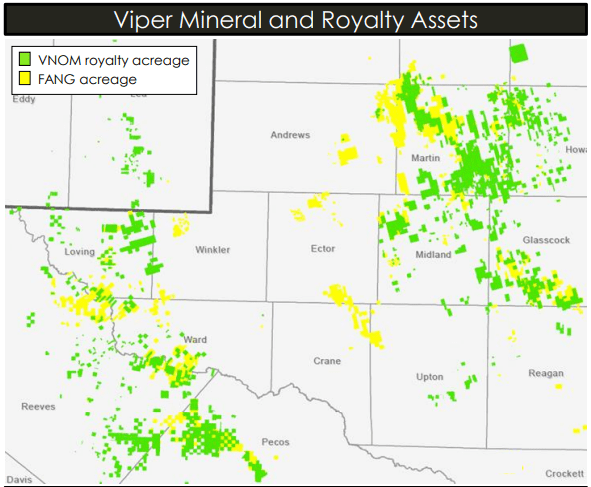

Viper Energy Partners LP (VNOM) is a mineral royalty corporation formed by Diamondback Energy, Inc. (FANG). This company owns and acquires mineral and royalty interests in oil and natural gas properties, primarily in the Permian Basin in West Texas. All of VNOM’s mineral interests are mainly leased to working interest owners (explorers, drillers, and producers) who bear the costs of operation and development. (Source: Nov. 2022 Investor Presentation.)

VNOM Investor Presentation (November 2022)

VNOM is a variable distribution payer. This is because production prices vary with commodity prices. However, we expect energy commodities to remain elevated for the foreseeable future due to significant underinvestment over the past years and irrational and dangerous political backlash towards hydrocarbon investing. As such, investors can expect to receive more significant dividends from this C-Corp. Additionally, VNOM’s distributions are tax-advantaged. The company notes that ~55% of 2022 distributions are expected to be reasonably determined not to constitute dividends for U.S. federal income tax purposes. These will be non-taxable reductions to the investor’s cost basis.

Note: VNOM is a partnership that has elected to be taxed as a C-Corp and therefore issues form 1099 to investors (rather than a K-1).

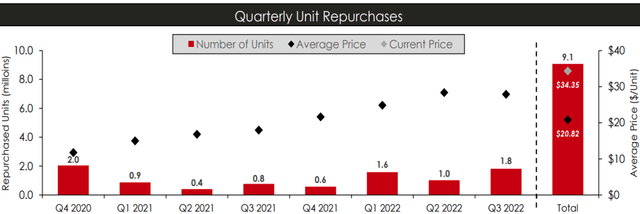

*The company projects $3.50 in annual distributable cash flow for a $90 WTI and steady production levels. While this calculates to a +10% DCF yield, the company does retain a portion for share buybacks, mineral interest acquisitions, and other miscellaneous expenses. VNOM’s TTM distribution yield reflects a sizable 7.4% yield. Notably, in Q3 VNOM repurchased ~1.8 million common units for ~$50.7 million (an average price of $27.91/unit). Remember, VNOM’s board has authorized repurchases of up to $750 million which reflects ~15% of the market cap. With VNOM heavily prioritizing buybacks, quarterly distributions may be a smaller percentage of the DCF than without the buybacks. Either way, the firm’s capital return policy is strong and long-term income investors will benefit from a shrinking pool of outstanding shares.

VNOM Investor Presentation (November 2022)

Diamondback is a majority shareholder of VNOM, owning 54% of its shares outstanding. Moreover, FANG also operates ~54% of its net royalty acreage. This relationship is a win-win for both companies as it reduces uncertainty around the pace of E&P project development and ensures consistent revenues. Under 30% of VNOM’s Midland basin acreage is developed today, meaning VNOM can offer years of sustained production (and distributions to shareholders) without making any capital expenditure. Large undeveloped acreage means VNOM offers sustainable growth for the foreseeable future.

If you are shying away from hydrocarbons due to heavy CAPEX and high debt, then VNOM is a worthy consideration. Its mineral and royalty interests provide much-needed exposure to a high-margin business with largely undeveloped assets and zero capital requirements to support its highly sustainable free cash flow. +7% yields from this cash machine during these times of high energy uncertainty.

Oil demand has proven to be recession-resistant

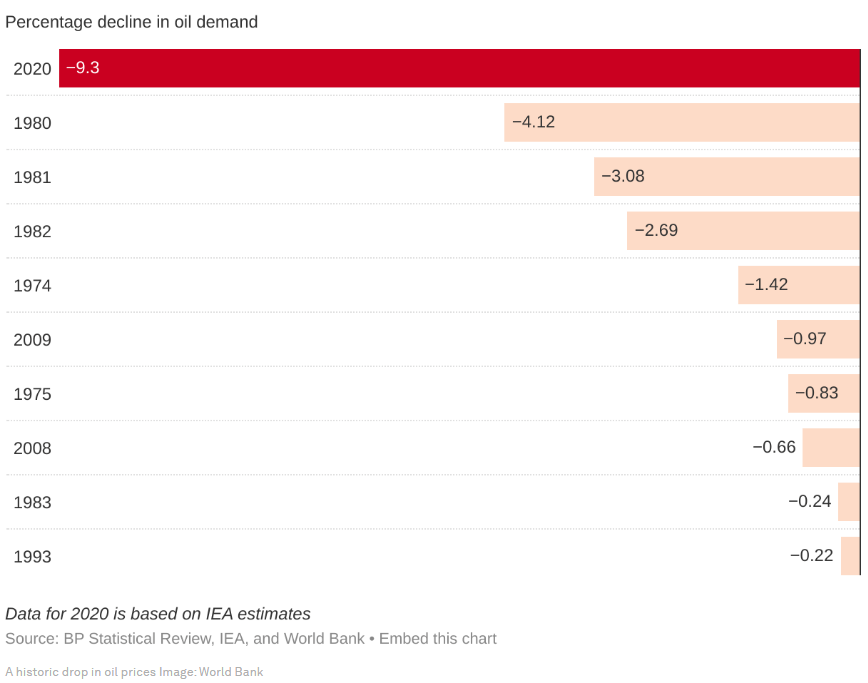

Contrary to popular belief, a recessionary environment does not significantly impact oil demand. The demand disappearance we saw in early 2020 was due to global lockdowns in response to the COVID-19 pandemic. It was a rare phenomenon that we don’t anticipate repeating in the same capacity. Even if it did, we would load up on the sell-off again because the world is simply not ready to replace these sources. (Source.)

BP Statistical Review (2020)

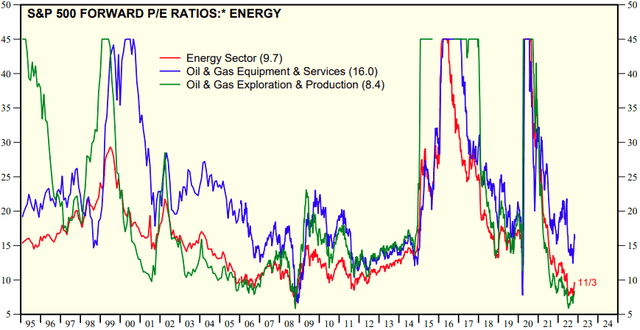

The energy sector is trading at historically cheap valuations due to fears of extended COVID-19 restrictions in China and of demand destruction from an upcoming recession. (Source.)

Yardeni Research

Today, hydrocarbon companies have much lower debt than in the previous oil boom (2015). These companies are very conservative in their capital expenses and are prioritizing dividends and share repurchases like never before. We need to jump into this critical yet financially undervalued sector and elevate our portfolio income.

Conclusion

Relying excessively on renewable energy sources which haven’t been built at scale yet carries tremendous risks. Private equity firms argue that the renewable energy sector cannot expand capacity quickly enough to attain net-zero emissions by 2050.

The G7 political landscape has resulted in the dangerous prioritization of renewables, with hydrocarbon companies starved of much-needed capital to continue meeting soaring demand. While a healthy balance is required to allow the long-term growth of renewables in the energy mix, the political focus appears to be driven by an obsession to eliminate the use of oil, natural gas, and coal. Today’s world is not ready to replace all three leading energy sources with wind and solar – experts and economists agree that the energy transition will take a long time, measured in decades.

Source: https://seekingalpha.com