Projecting long-term oil demand during the ongoing energy transition has been likened to trying to catch lightning in a bottle, with prognostications by different experts varying wildly. Oil demand growth predictions by 28 organizations including a handful of Big Oil companies through 2050 run the entire gamut from wildly bullish by US EIA (+34%) and Shell Waves (+18%) to deeply pessimistic by Energy Watch Group (-100%) and UNPRI 1.5 (-79%).

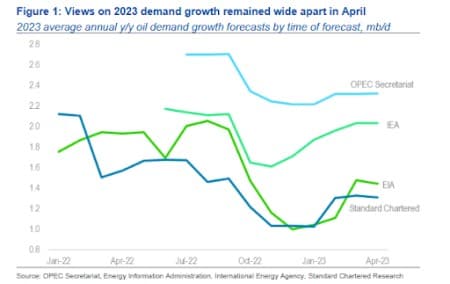

However, whereas projecting oil demand nearly three decades out is understandably challenging, experts cannot seem to agree on demand just months down the line. Four energy agencies including the IEA and OPEC Secretariat have made their predictions for oil demand growth in 2023. Looking at the chart below, their predictions show quite a wide degree of divergence, with the only common theme being that all four expect demand to grow compared to 2022, but all are less optimistic than they were a year or so ago.

The OPEC Secretariat is the most optimistic, and has predicted that demand will grow by some 2.3 million barrels per day while the International Energy Agency (IEA) sees demand expanding by 2.0 mb/d. On the lower end of the spectrum, Standard Chartered is the least optimistic, and sees demand growing only 1.3 mb/d while U.S.-based Energy Information Administration (EIA) expects growth to clock in at 1.4 mb/d.

Supply Crunch

In its latest monthly report, the IEA warned of a looming oil supply crunch with the agency expecting a deficit in the second half of the current year thanks to the latest OPEC+ production cuts. The agency has predicted that the gap between supply and demand will hit 2M bbl/day by Q3, which will push oil prices higher. However, IEA says the deficit will shrink to 400K bbl/day by year-end due to a production increase of 1M bbl/day from outside of OPEC+ vs. a 1.4M bbl/day decline from OPEC+.

U.S. crude is currently hovering around five-month highs thanks to OPEC+ surprise production cut plan, declining U.S. stockpiles, interruptions to pipeline supplies from Iraqi Kurdistan and weaker flows from Russia. Oil prices have now jumped nearly 30% since hitting March lows, a rally that has buoyed many energy stocks.

The oil markets have been oversupplied over the past few months thanks to overall weak demand following warmer than expected weather in Europe. The U.S. crude market started signaling oversupply in November, the first time supply exceeded demand in 2022. The front-month spread, traded in contango in November ahead of the December contract’s expiry. Front-month spread is used to gauge short-term supply-demand balances.

Luckily, the rest of the market retained a bullish structure known as backwardation, an indication that the bearishness could yet be a short-term one. Well, the bulls have finally been vindicated with the surplus in U.S. commercial inventories having all but disappeared. After months of providing ominous signals about the global oil market and the health of the U.S. economy, the weekly Energy Information Administration (EIA) report has started sending significantly more positive indicators.

However, experts are now optimistic that the build over the past two quarters will be gone by November if OPEC+ cuts are maintained for the whole year. In a slightly less bullish scenario, the same will be achieved by the end of the year if the current cuts are reversed around October.

Unfortunately, the same cannot be said about natural gas.

Natural gas prices have continued their relentless slide after the latest inventory data showed the markets continue to be well supplied. Natural gas (Henry Hub) prices are currently sitting at $2.29 per MMBtu down from $4.50 per MMBtu at the beginning of the year. EIA weekly data revealed that gas stocks clocked in at 1,855 Bcf vs. 1,830 Bcf for the previous week, good for +25 Bcf injection vs -23 Bcf for the previous week. Gas prices are now down a staggering 50 since the beginning of the year.

Unfortunately for the bulls, the short-term outlook remains bleak, with NatGasWeather saying storage surpluses are likely to expand further in the coming weeks due to light demand. Although there are some cool weather systems in the forecast, the latest weather models have trended warmer.

Thankfully, the longer term outlook is likely to be more favorable. Europe has failed to secure enough long-term LNG contracts to offset cut-off Russian gas imports, with Reuters predicting this may prove costly next winter and could sharply tighten the market. The European Union views natural gas as a bridge fuel in the transition to renewable energy, and buyers generally struggle to commit to long-term contracts. This means that Europe might be forced to buy more from the spot markets like it did in 2022, which in turn is likely to push prices up:

“Since the green lobby in Europe has managed to persuade politicians wrongly that hydrogen to a large extent can replace natural gas as an energy carrier by 2030, Europe has become far too reliant on spot and short term purchases of LNG,” consultant Morten Frisch told Reuters.

source:https://oilprice.com/