Oil markets have been relatively quiet this week, with muted trading in both Europe and the Americas ahead of Christmas.

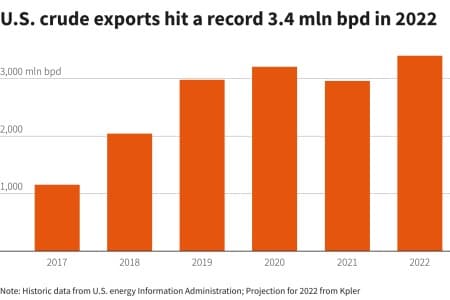

– For the first time since World War II, the United States might become a net exporter of crude next year as increasing domestic output will push even more oil toward the country’s terminals.

– Back in 2015, U.S. net imports stood at an average rate of 7 million b/d. In November, that figure shrunk to just a little above 1 million b/d amidst increasing exports.

– The US Energy Information Administration expects US crude production to come in at 11.7 million b/d in 2022 and add another 600,000 b/d next year to reach an all-time high of 12.3 million b/d.

– US crude exports have averaged 3.4 million b/d this year, reaching the annual peak in November, with almost 60% of all departures going through Corpus Christi, TX.

Market Movers

– Canada’s pipeline operator TC Energy (TSE:TRP) submitted a restart plan for the 622,000 b/d Keystone pipeline to US regulator PHMSA, with initial rumors indicating a full restart might take several months.

– Spain’s oil firm Repsol (MBE:REP) agreed to buy renewable energy company Asterion Energies for $600 million, extending its portfolio with 4.9 GW of solar and 2.8 GW of wind generation projects.

– Canada-based gold miner Barrick Gold (NYSE:GOLD) has been finally cleared by Pakistan’s high court to move ahead with the $7 billion Reko Diq copper-gold mine, one of the largest untapped open pit deposits.

Tuesday, December 20, 2022

Following last week’s price rebound that saw ICE Brent break back above the $80 per barrel threshold, there has been relatively little movement. Trading activity across the Atlantic Basin is muted as both Europe and the Americas get ready for the festive season, whilst market signals from Asia remain unclear as China is reportedly struggling to contain outbreaks of Covid following the easing of its restrictions. With no straightforward indication on US commercial stocks either, pre-Christmas trading sessions might remain relatively tame.

EU Greenlights Gas Price Cap. Following months of negotiations, the EU’s energy ministers agreed that a gas price cap will be triggered if TTF spot prices exceed €180 per MWh for three consecutive days, preventing any LNG trades at a price higher than €35/MWh vs the reference level.

Biggest German Gas Buyer Bailed Out. At an extraordinary meeting called for Monday, shareholders in German utility firm Uniper (ETR:UN01) approved a state bailout that has so far cost Berlin $53 billion and will see it owning just below 99% of the company.

Africa Balks at Biodiversity Pact. A UN summit agreed on a landmark deal to protect 30% of the world’s land and seas by 2030, but the Kunming-Montreal Global Biodiversity Framework risks being derailed by African nations whose objections to the deal were disregarded.

France Faces Further Nuclear Delays. French nuclear operator EDF (EPA:EDF) delayed the restart of several of its nuclear reactors. The reactors in question, Penly and Golfech, were halted due to stress corrosion and will now not restart until June 2023, denting the already-stressed winter power supply outlook.

Australia Wants Wind Energy. The government of Australia opened up its first zone for offshore wind farms off the southern Gippsland coast, paving the way for the $6 billion Star of the South project, estimated to have a production capacity of 2.2 GW.

Cold Snap Hinders Bakken Output. A cold snap sweeping across the US Midwest, sending temperatures into negative territory, has cut production in North Dakota’s Bakken basin by 200-250,000 b/d or 20% of the play’s total output.

Demand for LNG Tankers Hits Record High. The global order book for new LNG tankers has reached 170 carriers, a 95% increase year-on-year, with the liquefied gas market widely outperforming the wider shipping market.

Earthquake Bodes Ill for Texas Shale. A 5.4-magnitude earthquake rattled the Permian Basin late last week, impacting primarily Midland producers who now might have to curb wastewater disposal rates in the wider area.

US Loans Out SPR to Texas Refiners. The US Energy Department will loan out 1.8 million barrels of crude from its strategic reserves to ExxonMobil (NYSE:XOM) and Phillips66 (NYSE:PSX), seeking to mitigate the impact of the Keystone pipeline halt.

Majors Fight for Brazilian Pre-Salt. A consortium comprising TotalEnergies (NYSE:TTE), Petronas, and QatarEnergy won the rights to the offshore pre-salt Agua Marinha block in the Campos Basin, with state NOC Petrobras exercising its preferential option to join the pack.

US Gasoline Prices Edge Lower Again. Thanks to lower outright prices, higher-than-usual refinery utilization rates and gradually easing demand, US gasoline prices are now lower than a year ago ($3.14/USG) and might fall below $3/USG by Christmas, the lowest since May 2021.

Russia Readies Response to Oil Price Cap. Two weeks into the existence of the oil price cap, Russia’s authorities have claimed they are close to formalizing Moscow’s countermeasures, most probably banning sales of crude or product to the members of the Price Cap Coalition.

Saudi Arabia Talks Up China Downstream Integration. Agreeing to build a new 320,000 b/d refinery in Gulei, Fujian, top officials from Saudi Aramco (TADAWUL:2222) said China and Saudi Arabia should strive to develop an integrated downstream sector, cementing Riyadh’s spot as the key supplier to the Asian powerhouse.

Source: https://oilprice.com/